Mnews Entertainment

Sports

News

Animals

Babies

– 0 comment

Elon Musk is challenging the world by leading Tesla towards a future of robots and self-driving cars.

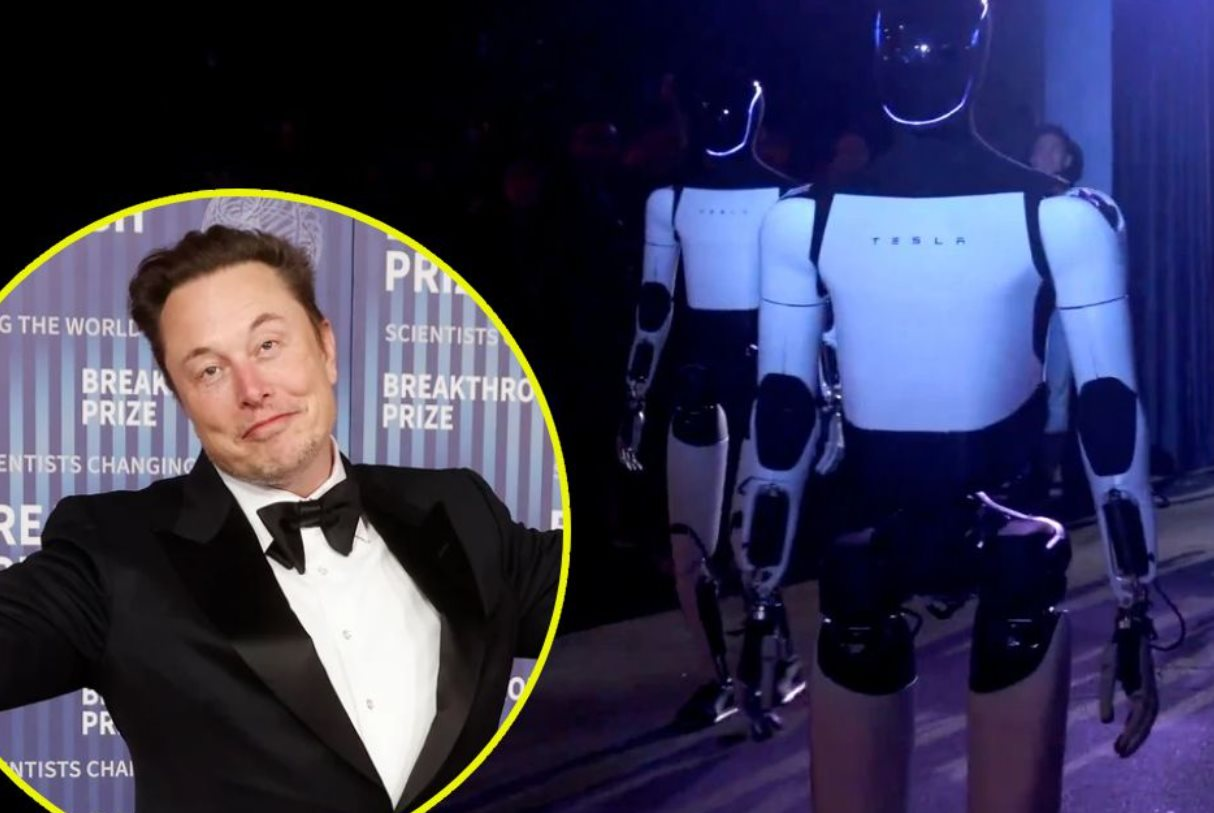

Last Thursday night, Elon Musk—never one to do anything small—showed off his latest creations: Not just a self-driving robot taxi, but also a self-driving robovan. And that’s not all: Musk also promised to deliver Star Wars-themed robots for $30,000 a pop.

One day, everyone on Earth will want a Muskbot, he said: “I think it’s going to be the biggest product ever, in any form.” But the next day, Wall Street reacted with a lack of interest: Tesla’s stock price fell nearly 9%, wiping out nearly $70 billion in market value.

There are many reasons why Tesla shareholders are skeptical of Musk’s presentation. To sum it up in two sentences: Self-driving taxis, at scale, involve a large number of technical and regulatory challenges. Meanwhile, history has shown that Musk has repeatedly promised exciting products and features for Tesla cars, only to have them either arrive long after he first made the promise, or… never arrive at all.

![]()

And those Muskbots, at this point, certainly seem more like a special effect than a product. The question is where they came from, Tesla itself or Twitter—the social network Musk once bought.

Before Musk bought Twitter in October 2022, Musk’s bio was “tech freak who did the impossible, revolutionizing cars and rockets.” Now, that bio has been changed to “tech freak who was wildly successful when it came to cars and rockets, but whose ownership of Twitter was wildly erratic and self-destructive.”

Many Musk fans have been comfortable with both versions of the world’s richest man for a while now. The theory is that even if Musk messes up Twitter (now X), it doesn’t diminish what he’s accomplished at Tesla and SpaceX.

Musk is “the bravest, most creative person on the planet,” former Netflix CEO Reed Hastings declared in November 2022 — a month into Musk’s tumultuous tenure at Twitter. “Give this guy a chance.”

Since then, Musk has seen advertisers flee and the value of his $44 billion investment plummet. And Tesla investors, meanwhile, seem to be less forgiving. Since Musk bought Twitter—after failing to back out of a deal to buy Twitter—Tesla’s stock has fallen 4.7%. Over the same period, the S&P has risen 49%.

As you can see, Tesla is a volatile stock. If this article were published in July 2023, the conclusion might be completely different.

Meanwhile, Musk still has plenty of fans — some of them pretty serious tech investors, like Benchmark’s Bill Gurley — who think Musk’s approach to self-driving cars will ultimately be much better and cheaper than Uber and Waymo’s.

If that happens, Tesla will end up owning a huge market. That means their stock is actually undervalued.